The bilateral trade relationship between India and the United States represents one of the most significant and complex economic partnerships in the contemporary global economy. This comprehensive analysis examines the multifaceted dimensions of this trade relationship, drawing from extensive data covering goods, services, investment flows, and recent policy developments that are reshaping the landscape of US-India economic cooperation.

Executive Summary

US-India bilateral trade reached a record $212.3 billion in 2024, representing an 8.3% increase from the previous year. This relationship encompasses both traditional goods trade ($128.9 billion) and rapidly expanding services trade ($83.4 billion). However, the partnership faces unprecedented challenges with the implementation of reciprocal tariffs by the Trump administration, potentially affecting up to $55 billion of Indian exports to the US market.

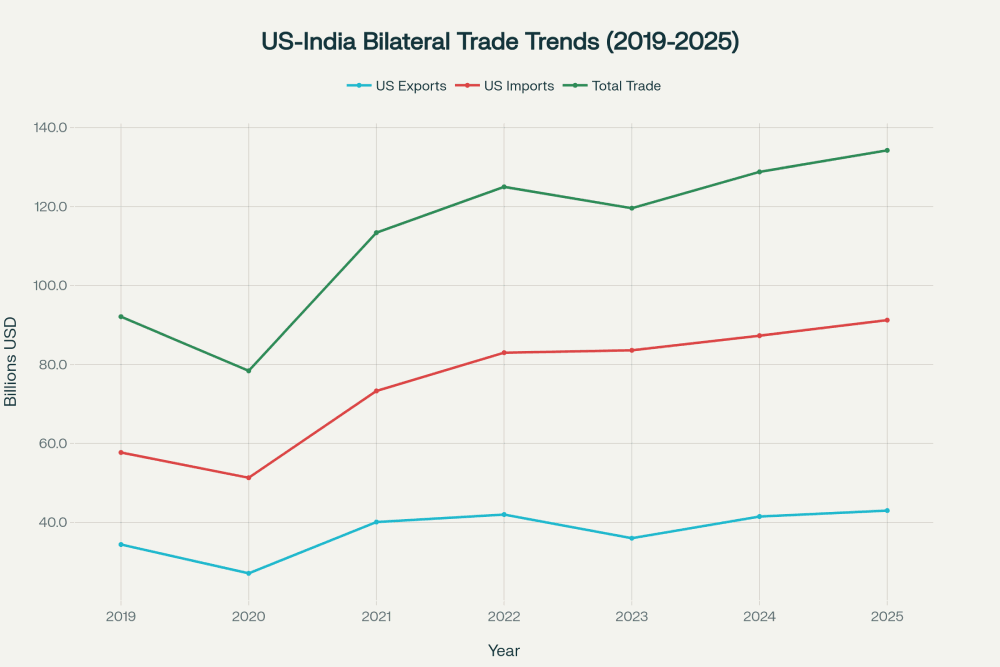

Line chart showing US-India bilateral trade trends from 2019-2025, displaying US exports, imports, and total trade values

Trade Volume and Growth Trends

Historical Trade Evolution

The US-India trade relationship has experienced remarkable growth over the past decade, despite periodic volatilities. Total bilateral trade expanded by 72% between 2017-18 and 2022-23, demonstrating the resilience and growing interdependence of the two economies. The relationship weathered significant challenges, including the 2020 pandemic impact that saw trade volumes drop to $78.4 billion before recovering strongly to $134.24 billion by 2025.

The trade relationship exhibits distinct patterns of growth and contraction that reflect broader economic cycles. The 2020-2021 period saw a dramatic recovery with exports growing 48% and imports increasing 42.9%. This recovery pattern underscores the fundamental strength of the economic relationship and the complementary nature of the two economies.

Current Trade Composition

Goods trade continues to dominate the bilateral relationship, accounting for 61% of total trade in 2024. US imports from India totaled $87.3 billion in goods, while US exports to India reached $41.5 billion, creating a goods trade deficit of $45.8 billion from the US perspective. The services sector, while smaller in absolute terms at $83.4 billion, has shown more balanced characteristics with the US achieving near parity in 2024.

The growth trajectory indicates services trade is expanding more rapidly than goods trade. Services exports from India to the US have grown at compound annual rates exceeding 15% in recent years, driven primarily by information technology and business process services. This trend reflects India’s competitive advantages in knowledge-based services and the US economy’s increasing digitalization.

Sectoral Analysis of Trade Flows

Indian Exports to the United States

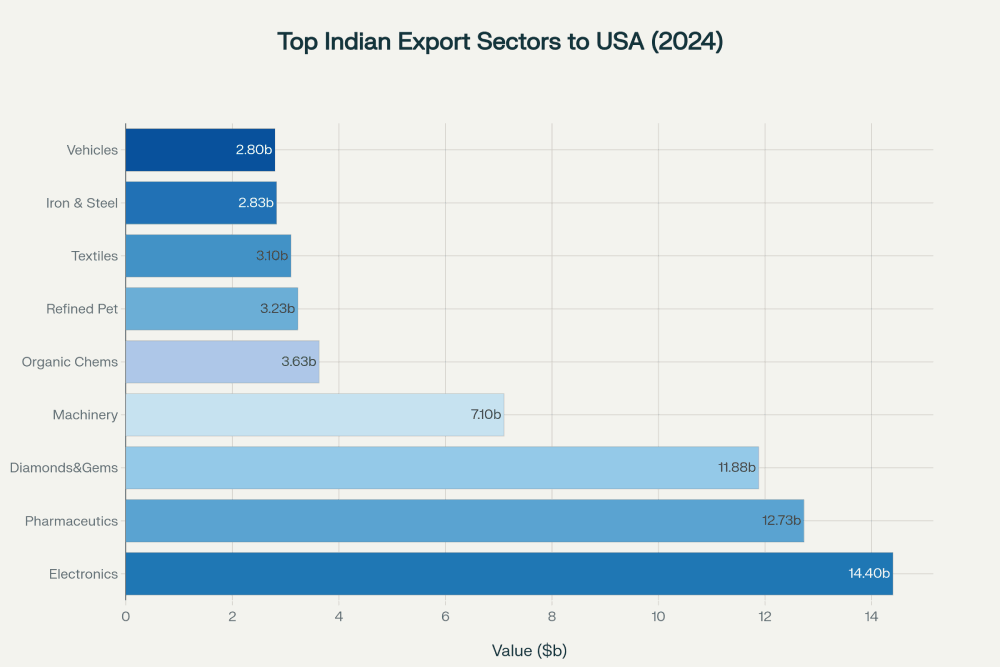

Horizontal bar chart showing top Indian export sectors to USA in 2024 by value in billions USD

India’s export portfolio to the United States demonstrates significant diversification across multiple high-value sectors. Electronics emerged as the largest export category in 2024 at $14.4 billion, followed closely by pharmaceuticals at $12.7 billion and diamonds and gems at $11.9 billion. This diversification represents a strategic evolution from India’s traditional textile and agricultural exports toward higher value-added manufacturing and technology products.

The pharmaceutical sector holds particular strategic importance, with India supplying 40% of generic medicines to the US market. This relationship has created deep supply chain interdependencies, with Indian pharmaceutical companies providing cost savings of approximately $220 billion to the US healthcare system in 2022 alone. Major Indian pharmaceutical companies including Sun Pharmaceutical, Dr. Reddy’s Laboratories, and Cipla derive 30% or more of their revenues from US markets.

India’s electronics exports to the US surged dramatically, with smartphone exports alone reaching $10.9 billion in 2024-25. This growth reflects successful government initiatives including the Production Linked Incentive (PLI) schemes and the strategic shift of global technology companies from China to India for manufacturing. Apple’s iPhone production in India exemplifies this trend, with India surpassing China as the top supplier of iPhones to the US market.

US Exports to India

US exports to India encompass a diverse range of products and services, reflecting America’s competitive advantages in high-technology manufacturing, energy, and advanced services. Key export categories include crude oil and refined petroleum products, aircraft and aerospace equipment, and sophisticated machinery. The US has also emerged as a significant supplier of agricultural products, particularly soybeans and corn, benefiting from India’s growing protein consumption and changing dietary patterns.

The services component of US exports includes financial services, professional and technical services, and educational services. Indian students studying in the US contribute over $25 billion annually to the American economy through tuition and living expenses, representing one of the largest invisible export sectors from the US perspective.

Services Trade Dynamics

Information Technology and Digital Services

India’s dominance in global IT services exports is perhaps nowhere more pronounced than in its relationship with the United States. The US accounts for approximately 54% of India’s software services exports, making it the most critical market for India’s $190.7 billion IT services industry. This relationship extends beyond traditional software development to encompass artificial intelligence, cloud computing, data analytics, and emerging technology services.

India’s total digital services exports reached $257 billion in 2023, positioning it as the fourth-largest global exporter of digitally deliverable services. The US market absorption of these services creates a multiplier effect throughout the Indian economy, supporting millions of jobs and driving technological innovation across multiple sectors.

Business and Professional Services

Beyond IT services, India has developed significant capabilities in business process outsourcing, research and development services, and professional consulting. Business services contribute approximately $50.2 billion to India’s global services exports, with a substantial portion directed toward US markets. This includes legal process outsourcing, accounting services, market research, and specialized consulting services that leverage India’s English-speaking workforce and cost advantages.

The growth in R&D services reflects the increasing sophistication of India’s service offerings, with multinational corporations establishing global capability centers (GCCs) in India to serve their worldwide operations. Over 1,600 GCCs operate in India, with many serving as primary innovation hubs for US-based parent companies.

Trade Balance and Economic Implications

Goods Trade Imbalance

The persistent goods trade deficit from the US perspective represents a fundamental characteristic of the bilateral relationship. The $45.8 billion deficit in 2024 reflects structural differences in the two economies’ comparative advantages. India’s competitive manufacturing costs, particularly in labor-intensive sectors, create natural export advantages, while the US economy’s consumption patterns and import dependencies drive demand for Indian products.

However, this narrative requires nuance when considering the broader economic relationship. Research by the Global Trade Research Initiative suggests that when accounting for services trade, digital transactions, educational services, and defense sales, the US actually enjoys a $35-40 billion surplus with India. This analysis includes Indian student expenditures in the US, licensing fees, royalty payments, and defense procurement that don’t appear in traditional goods trade statistics.

Services Trade Balance Evolution

The services trade balance has shown remarkable evolution toward equilibrium. In 2024, the US achieved a slight surplus of $102 million in services trade with India, representing a dramatic shift from the $10.3 billion deficit recorded in 2021. This convergence reflects both the growth in US services exports to India and the maturation of India’s domestic service capabilities that reduce import dependence.

Investment Flows and Economic Integration

Foreign Direct Investment Patterns

The US ranks as India’s third-largest source of foreign direct investment, contributing $4.99 billion in 2023 and representing 9% of total FDI inflows. Cumulative US investment in India exceeds $60 billion since 2000, spanning diverse sectors including technology, manufacturing, healthcare, and financial services. This investment pattern reflects long-term strategic commitments rather than portfolio flows, creating lasting economic integration.

India’s outward investment to the US totaled $737 million in FY23, making the US India’s top overseas FDI destination. While smaller in absolute terms, this investment represents growing Indian corporate confidence in the US market and increasing integration of Indian companies into global value chains. Major Indian technology companies, pharmaceutical manufacturers, and steel producers have established significant US operations through both greenfield investments and acquisitions.

Investment Potential and Opportunities

Analysis by the International Trade Centre identifies $30 billion in unrealized export potential from the US to India, concentrated in sectors including jewelry and precious metals, motor vehicles, machinery, pharmaceutical components, and chemicals. This potential reflects both market access opportunities and the ongoing modernization of the Indian economy that creates demand for sophisticated industrial inputs and consumer goods.

The investment relationship extends beyond direct equity flows to encompass technology transfer, joint ventures, and strategic partnerships. US companies have been instrumental in India’s digital transformation, providing cloud infrastructure, enterprise software, and telecommunications equipment that underpins India’s economic modernization.

Current Trade Challenges and Tariff Impacts

Reciprocal Tariff Implementation

The implementation of reciprocal tariffs by the Trump administration represents the most significant challenge to the US-India trade relationship in recent decades. The 25% tariff imposed in July 2025, subsequently increased to 50% with additional penalties for Russian oil purchases, affects the vast majority of Indian exports to the US. This represents “one of the toughest trade actions the US has taken against a key trading partner in recent years”.

Unlike tariff regimes applied to other countries, India has been denied product-level exemptions, including categories typically protected such as pharmaceuticals, critical minerals, and energy products. This comprehensive approach affects approximately $55 billion of Indian exports, representing 63% of total goods exports to the US.

Sectoral Vulnerabilities

The tariff implementation creates differential impacts across sectors based on market concentration and substitutability. The engineering goods sector faces the highest absolute exposure at $19.2 billion in annual exports, encompassing automotive components, industrial machinery, and precision instruments. The gems and jewelry sector, contributing $11.9 billion annually, faces particular vulnerability due to the discretionary nature of luxury consumption and availability of alternative suppliers.

Iron and steel products face the most severe tariff rates at 50%, reflecting both trade policy objectives and national security considerations. This sector exemplifies the complexity of global supply chains, as Indian steel exports often incorporate raw materials sourced from multiple countries before final processing and export.

The pharmaceutical sector, while currently exempted, operates under significant uncertainty. President Trump has indicated intentions to impose graduated tariffs on pharmaceutical imports, potentially starting with small levies and escalating to 250% over several years. Given India’s 40% market share in US generic medicines, such measures could significantly impact healthcare costs and drug availability in the United States.

Economic Impact Projections

Economic modeling suggests the tariff regime could reduce bilateral trade by $4-5 billion annually in affected sectors. The broader economic impact extends beyond direct trade effects to encompass supply chain disruptions, investment uncertainty, and reduced competitiveness for Indian exporters in global markets. Industries dependent on just-in-time supply chains and those with thin profit margins face the most immediate pressures.

The tariff implementation also creates secondary effects through currency depreciation and inflation pressures. The uncertainty surrounding trade policy has contributed to rupee volatility and increased hedging costs for Indian exporters, further eroding competitiveness in price-sensitive sectors.

Strategic Economic Considerations

Geopolitical Context

The trade relationship operates within broader geopolitical considerations that extend beyond bilateral economic interests. The strategic partnership between India and the US encompasses defense cooperation, technology sharing, and alignment on Indo-Pacific security issues. These broader strategic considerations create both opportunities and constraints for economic policy makers in both countries.

The tension between economic interdependence and strategic autonomy manifests in various policy decisions. India’s continued energy imports from Russia, which triggered additional US tariffs, reflects this complex balancing act between economic interests and geopolitical alignment. India’s position that it sources energy based on cost and availability rather than geopolitical considerations creates ongoing friction with US policy objectives.

Technology Transfer and Innovation

The bilateral relationship increasingly centers on technology cooperation and innovation partnerships. US-India collaboration in semiconductors, artificial intelligence, clean energy, and biotechnology represents areas of mutual strategic interest that transcend traditional trade metrics. The US-India Initiative on Critical and Emerging Technology (iCET) framework provides a structure for deepening cooperation in advanced technology sectors.

India’s emergence as a global technology hub creates opportunities for US companies while also generating competitive pressures in certain segments. The relationship balances cooperation in fundamental research and development with competition in commercial markets, requiring sophisticated policy coordination to maximize mutual benefits.

Future Outlook and Recommendations

Short-term Adjustments

The immediate priority for both governments involves stabilizing the trade relationship and providing predictability for business planning. The stated objective of expanding bilateral trade to $500 billion by 2030 requires resolution of current tariff disputes and creation of frameworks that support sustained growth.

Indian exporters are already implementing diversification strategies, including geographic market expansion and supply chain restructuring to reduce US market concentration. However, the scale and sophistication of the US market make it irreplaceable for most Indian industries, necessitating policy solutions rather than complete market substitution.

Long-term Strategic Framework

The fundamental complementarity of the two economies suggests significant potential for expanded cooperation despite current challenges. India’s demographic dividend and growing consumer market align with US strengths in technology, capital goods, and services. Realizing this potential requires policy frameworks that address legitimate concerns about trade imbalances while preserving the benefits of economic integration.

The services trade relationship provides a model for balanced growth that benefits both economies while avoiding the zero-sum characteristics of some goods trade disputes. Expanding cooperation in digital services, professional services, and knowledge-intensive industries could provide a foundation for broader trade relationship stability.

The investment relationship offers another avenue for deeper integration that creates mutual stakes in each other’s economic success. Encouraging US investment in Indian manufacturing and infrastructure while supporting Indian investment in US technology and innovation sectors could create positive-sum outcomes that strengthen the overall relationship.

Conclusion

The US-India trade relationship represents one of the most dynamic and complex bilateral economic partnerships in the contemporary global economy. With total bilateral trade exceeding $212 billion annually and growing at rates that significantly exceed global averages, the relationship demonstrates both tremendous potential and significant challenges.

The current tariff disputes, while serious, operate against a backdrop of fundamental economic complementarity and shared strategic interests. The relationship’s evolution toward greater services trade balance and increasing investment integration suggests pathways for addressing current tensions while building foundations for sustained growth.

Success in realizing the $500 billion trade target by 2030 will require policy innovation that addresses legitimate concerns about trade imbalances while preserving the benefits of economic integration. The relationship’s strategic importance extends far beyond bilateral trade statistics to encompass broader questions of global economic governance, technological innovation, and geopolitical stability in the Indo-Pacific region.

The data clearly demonstrates that despite periodic tensions, the underlying trajectory of the US-India economic relationship remains strongly positive. Both economies benefit significantly from their integration, and both face challenges that require continued cooperation and policy coordination. The current period of trade policy uncertainty represents both a challenge and an opportunity to establish more durable frameworks for economic cooperation that can support sustained growth in the decades ahead.