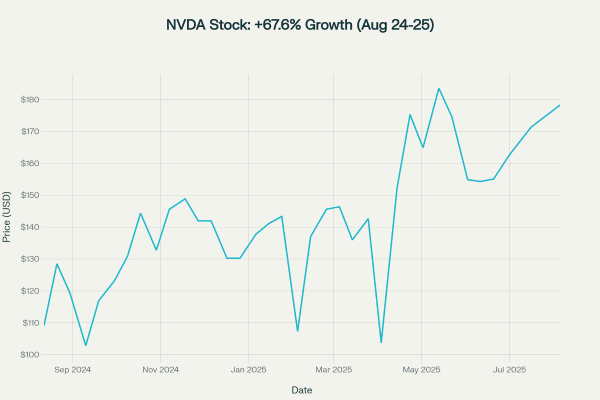

NVIDIA Corporation (NASDAQ: NVDA) has emerged as the undisputed leader of the artificial intelligence revolution, transforming from a gaming graphics company into the world’s most valuable technology company with a market capitalization of $4.46 trillion. The company’s stock has delivered extraordinary returns of +67.6% over the past 12 months and +1,500% over five years, driven by unprecedented demand for AI computing infrastructure.

Nvidia stock price showing 67.6% growth from $109 to $183 over 12 months

Current Financial Performance

Record-Breaking Revenue Growth

NVIDIA’s financial performance in fiscal year 2025 represents one of the most remarkable growth stories in corporate history:

- Total Revenue: $130.5 billion (up 114% year-over-year)

- Q4 FY2025 Revenue: $39.3 billion (up 78% YoY)

- Q1 FY2026 Revenue: $44.1 billion (up 69% YoY)

- Operating Income FY2025: $81.5 billion (up 147% YoY)

- Gross Margin: 73.0% in Q4 FY2025

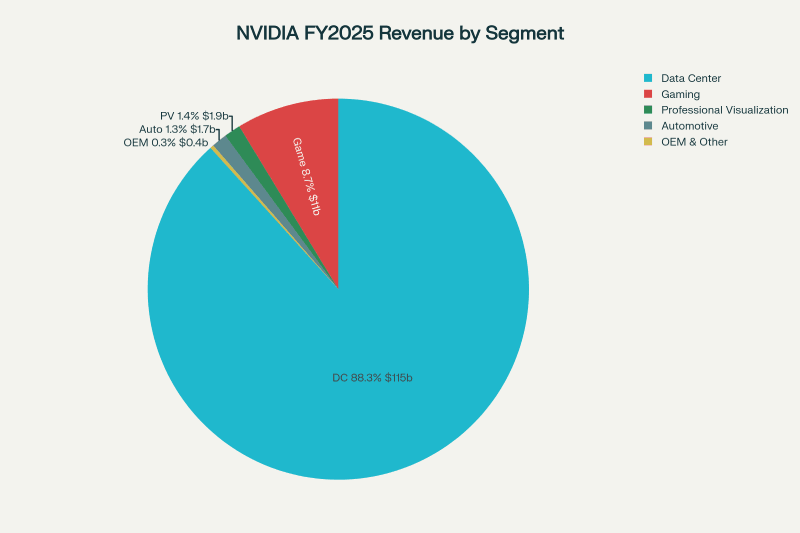

Data Center Dominance

The Data Center segment has become NVIDIA’s primary growth engine, representing the largest business transformation in semiconductor history:

Nvidia’s revenue breakdown showing Data Center segment dominance at 88.3%

- Data Center Revenue FY2025: $115.2 billion (up 142% YoY)

- Percentage of Total Revenue: 88.3% (up from 55.6% in FY2023)

- Q4 FY2025 Data Center Revenue: $35.6 billion (up 93% YoY)

Business Segment Performance

| Segment | FY2025 Revenue | % of Total | YoY Growth |

|---|---|---|---|

| Data Center | $115.2B | 88.3% | +142% |

| Gaming | $11.4B | 8.7% | +9% |

| Professional Visualization | $1.9B | 1.4% | +21% |

| Automotive | $1.7B | 1.3% | +55% |

| OEM & Other | $0.4B | 0.3% | +27% |

Market Position and Competitive Landscape

Dominant Market Share

NVIDIA has achieved unprecedented market dominance across multiple segments:

- GPU Market Share: 92% (vs. AMD 8%, Intel <1%)

- AI Accelerator Market Share: 80-95% globally

- Data Center AI Chip Market: Controls majority of $400B projected market

Competitive Dynamics

Primary Competitors:

- Advanced Micro Devices (AMD): 8% GPU market share, focusing on MI300X data center GPUs

- Intel Corporation: Minimal discrete GPU presence, developing Gaudi 3 AI accelerators

- Custom Silicon Providers: Google (TPU), Apple (M-series), Amazon (Trainium/Inferentia)

Q1 2025 Revenue Comparison:

Future Growth Drivers

AI Market Expansion

The global artificial intelligence market presents massive growth opportunities for NVIDIA:

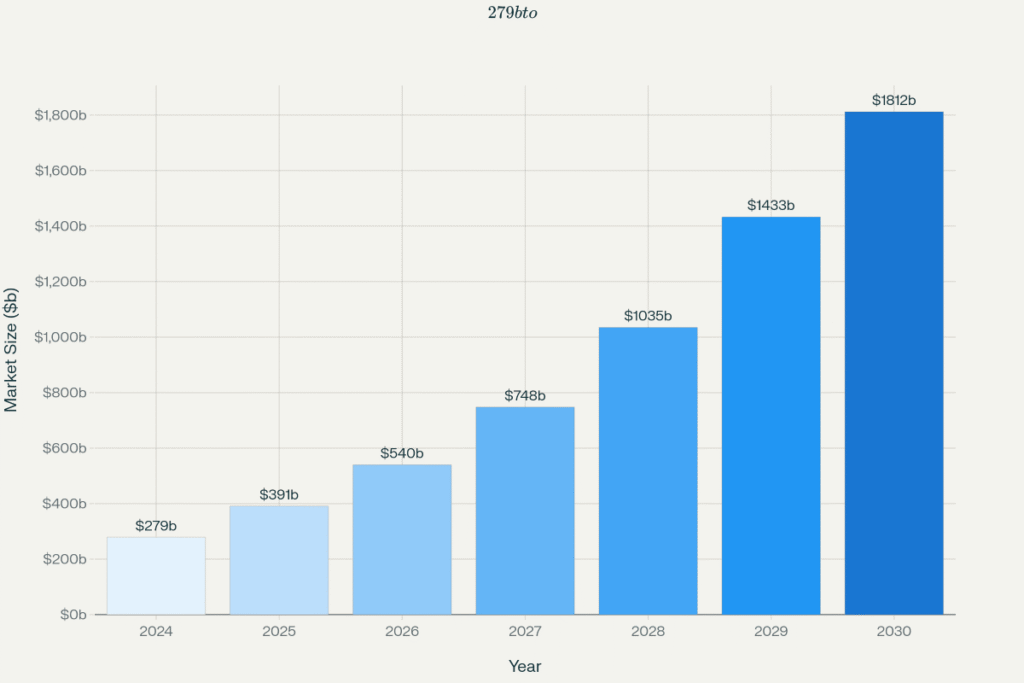

Global AI market projected to grow from $279B to $1.8T by 2030 (35.9% CAGR)

Market Projections:

Key Growth Segments:

- Enterprise AI: $24B (2024) → $473B (2030) at 81.6% CAGR

- AI Chip Market: $20B (2020) → $400B (2030)

- Data Center Infrastructure: Exponential scaling requirements

Product Innovation Pipeline

Blackwell Architecture:

- Next-generation AI supercomputing platform with “amazing demand”

- NVL72 systems in full-scale production

- Billions in sales achieved in first quarter

Future Roadmap:

- Rubin Architecture: Expected introduction in 2026

- Enhanced AI Training: Reasoning AI capabilities driving new scaling laws

- Physical AI: Robotics and autonomous systems expansion

Valuation Analysis

Current Valuation Metrics

Analyst Price Targets

Consensus Estimates:

- Average Price Target: $185.33

- Highest Target: $250.00 (Goldman Sachs)

- Lowest Target: $100.00

- Upside Potential: ~11% from current levels

Risk Factors and Challenges

Geopolitical and Regulatory Risks

China Export Restrictions:

- H20 chip limitations created $4.5B inventory charge in Q1 FY2026

- Potential $50B revenue impact from Chinese market restrictions

- Recent licensing developments may provide some relief

Competitive Threats

Emerging Competition:

- Custom silicon development by major tech companies

- AMD’s aggressive positioning with MI300X accelerators

- New AI chip startups receiving billions in venture funding

Market Concentration Risk:

- Heavy dependence on data center segment (88.3% of revenue)

- Customer concentration among hyperscale cloud providers

- Cyclical semiconductor market dynamics

Technical and Operational Challenges

Supply Chain Vulnerabilities:

- Complex global manufacturing dependencies

- Advanced node semiconductor scarcity

- Geopolitical supply chain tensions

Valuation Concerns:

- High PE ratios suggest elevated expectations

- Market cap exceeding many national GDPs

- Potential for correction if AI growth slows

Future Outlook and Investment Thesis

Bull Case Scenarios

Accelerating AI Adoption:

- Enterprise AI transformation in early stages

- Sovereign AI initiatives by nations worldwide

- Physical AI and robotics representing new frontiers

Technology Leadership:

- CUDA ecosystem creating significant switching costs

- Continuous innovation maintaining competitive moats

- Scale advantages in R&D and manufacturing

Bear Case Considerations

Growth Deceleration Risks:

- AI training needs may taper within 18 months

- Double-ordering by customers inflating near-term demand

- Revenue decline projected starting 2026 by some analysts

Competitive Pressure:

- Custom silicon reducing reliance on NVIDIA chips

- Open-source alternatives to CUDA development

- Price competition from AMD and emerging players

Price Projections

Analyst Consensus (Next 12 Months):

- Base Case: $185-190 (2-4% upside)

- Bull Case: $250+ (37% upside)

- Bear Case: $120-140 (25-35% downside)

Long-term Forecast (2026-2030):

- Optimistic Scenario: $300-500 range if AI market fulfills potential

- Moderate Scenario: $200-250 with steady growth

- Conservative Scenario: $150-180 with normalization

Strategic Recommendations

For Growth Investors

NVIDIA represents a generational opportunity to participate in the AI revolution, despite current valuation premiums. The company’s technological leadership and market position suggest continued outperformance.

For Value Investors

Current prices reflect significant future growth expectations. Consider dollar-cost averaging or waiting for market corrections to establish positions.

For Risk-Averse Investors

Monitor quarterly earnings trends, competitive dynamics, and geopolitical developments closely. The stock’s volatility (52.9% annualized) requires careful position sizing.

Conclusion

NVIDIA has successfully positioned itself as the infrastructure provider for the artificial intelligence era, similar to how Intel dominated personal computing or Microsoft controlled software platforms. While current valuations are elevated, the company’s technological moats, market leadership, and enormous addressable market suggest continued strong performance over the long term.

The next earnings announcement on August 27, 2025 will provide crucial insights into demand sustainability, competitive pressures, and management’s outlook for the remainder of fiscal 2026. Investors should monitor Blackwell ramp progress, China market developments, and gross margin trends as key performance indicators.

With the global AI market projected to reach $1.8 trillion by 2030, NVIDIA remains well-positioned to capitalize on this transformational technology shift, making it a compelling long-term investment despite near-term volatility risks.