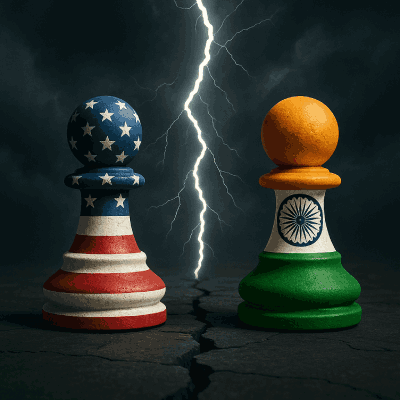

In a move that sent shockwaves through global trade corridors, President Donald Trump has imposed a steep 50% tariff on Indian imports. This dramatic escalation is not just a trade tactic—it’s geopolitical chess, played on the oil-soaked board of the Russia-Ukraine conflict.

At the heart of this tariff war is one volatile issue: India’s continued import of Russian oil.

But the question we all want answered is:

Who will suffer more—India or the United States?

Let’s decode the drama.

Why Did the U.S. Turn the Tariff Screw on India?

This isn’t your average trade spat over steel or software. Here’s what lit the fuse:

- India’s Oil Trade with Russia

- India now sources 35% of its crude oil from Russia, making it Russia’s top oil buyer.

- The White House alleges these purchases are undermining U.S. sanctions and fueling the Russian war machine in Ukraine.

- Trump’s Direct Accusation

- The U.S. President bluntly accused India of indifference:

“India doesn’t care how many people in Ukraine are being killed by the Russian war machine.”

- The U.S. President bluntly accused India of indifference:

- Secondary Sanctions in Action

- The U.S. has used similar tactics before—targeting Venezuelan oil buyers with tariffs.

- Now, India—a major ally and trade partner—is facing the same playbook.

- Double Standards or Diplomatic Flip?

- India’s foreign ministry claims the U.S. initially encouraged Russian energy purchases to stabilize global prices.

- But with the war dragging on, the U.S. has flipped its stance—and raised the tariff bar as a pressure tactic.

The Trade Powerplay: Setting the Stage

India and the U.S. have built a deeply intertwined trade relationship over the decades:

- In 2024, total trade in goods and services between the two nations stood at $212.3 billion, an 8.3% growth over 2023.

- India enjoys a trade surplus—exporting more to the U.S. than it imports. In 2024, India exported $88 billion worth of goods while importing $43 billion, leading to a $45 billion surplus.

- The U.S. runs a consistent trade deficit with India, particularly in goods ($45.8 billion in 2024).

So, when the U.S. slaps a 50% tariff on Indian imports, it’s not just a political move—it’s an economic gamble.

Who Stands to Lose More? Let’s Break It Down

1. India: A Hit to Exporters, But Resilient Services Could Cushion the Blow

India exports a diverse basket of goods to the U.S., including:

- Electronics ($12.3B)

- Gems & Jewelry ($9.1B)

- Pharmaceuticals ($8.7B)

- Machinery, Vehicles, and Textiles

Sectors like pharmaceuticals and software services, where India is a global leader, may survive due to critical U.S. dependencies. For example:

- India is the world’s top supplier of generic drugs—accounting for 20% of global exports.

- IT and business services form a massive part of the $83.4 billion services trade, with India’s software exports booming 27% in FY23.

But sectors like gems, textiles, and automobiles—which are price-sensitive—could suffer from the tariff shock.

Short-term Indian pain? Yes.

Small-to-medium enterprises and job-heavy industries may feel the heat.

Long-term resilience? Likely. India’s low production costs, domestic market strength, and trade pivot towards Asia, Europe, and Africa offer a safety net

2. USA: Higher Prices, Fewer Options—and No Easy Substitutes

The U.S. imported $87.3 billion in goods and $41.6 billion in services from India in 2024. Key imports include:

- Generic medicines (India is irreplaceable here)

- Refined petroleum products

- IT services and customer support

- Diamond processing

- Cost-efficient manufacturing inputs

Let’s be blunt: American consumers and businesses will pay more.

- Drug prices may rise, especially generics for chronic conditions.

- Tech and back-office services will cost more if companies need to shift operations from India to expensive Western or Southeast Asian alternatives.

- Retail sectors may struggle with price hikes on jewelry, apparel, or low-cost electronics.

Short-term U.S. pain? Yes, especially for consumers.

Long-term options? Limited. Unlike India, the U.S. may not find easy alternative suppliers at India’s price-quality balance

A Strategic Misfire?

While the U.S. aims to punish India’s oil diplomacy, the strategy could backfire:

- Russia may divert oil to other allies, India might deepen ties with China or Iran.

- India’s growing domestic demand means it can weather the storm by shifting inward.

- The U.S. risks appearing inconsistent—first encouraging Russian oil imports, now penalizing them.

This move also sends a troubling signal to other U.S. allies:

Follow Washington’s foreign policy—or face economic fire.

The Historical Lens: Lessons from 1991 to Today

India once had one of the most closed economies in the world. But after the 1991 liberalization, its GDP soared from $266B to $2.3T by 2018—fueled by foreign trade.

Meanwhile, U.S.-India trade has grown 20x since the 1990s, reflecting interdependence, not rivalry. A hardline tariff today risks unraveling decades of economic progress on both sides.

So, Who Will Hurt More?

| Metric | India | USA |

| Trade Surplus Position | +$45B | -$45B |

| Export Reliance on US | Moderate | High (for specific sectors) |

| Substitute Markets | Multiple (Europe, ASEAN, Gulf) | Limited for cost-quality mix |

| Consumer Impact | Mild to moderate | High (price hikes likely) |

| Political Impact | Manageable | Potential backlash |

Verdict: The U.S. Will Likely Feel More Pain, Politically and Economically

What Can Be Done Now?

- India should diversify further into Europe, Africa, and ASEAN, and boost domestic consumption.

- U.S. policymakers must rethink the long-term cost of alienating a strategic democratic ally in Asia.

- Both nations can revisit the bilateral trade agreement talks and consider tariff rollbacks tied to reform assurances.

Final Takeaway: When Giants Clash, Global Supply Chains Shake

This trade dispute is not a zero-sum game. Both India and the U.S. are essential to each other’s economic ecosystems. While the 50% tariff may feel like a bold political move today, its consequences could ripple across global markets tomorrow.

For now, India’s resilience, sectoral diversity, and emerging trade alliances make it better positioned to absorb the hit. But the real loser? Possibly the American consumer—caught between politics and price tags.